Did we really pay to recommend we, as consumers, ought to pay more?

Funded by taxpayers to the tune of $200,000, the report – prepared by EY (formerly Ernst & Young) – was to be the basis of recommendations on how to reform provincial liquor laws and pricing in British Columbia. Recommendations which, as it turns out, have been to the benefit of nobody but the government.

Myriad questions surround the document, obscuring certainty like a smokescreen and negating any chance at opening an appropriate and well informed dialogue with our government. It is one thing to say that we do not approve of increased prices on the products we enjoy, but as with any discussion, being armed with the facts – for better or worse – makes for a much more valuable exchange of thoughts and ideas. Ultimately it was released to the public – entirely redacted, save for the title slide, a “Background” slide with bullet points about the need to adjust prices (very much the same statements made repeatedly elsewhere), and an “Additional Slides” page that is completely empty. 17 pages were omitted.

The fact that the report is redacted at all is unsettling. Granted that it is not uncommon to see this in government documents protected under FOIPPA, it is a document on which laws were revised in the “best interest of consumers”. If this was truly the course of action that best serves the interest of consumers, then why not stand behind those findings in a manner that is as honest and transparent as possible? On what metrics or model was this platform built, and were there other solutions proposed?

Since mid-June, I have been working to get tangible answers to very specific questions from Minister Anton’s camp. Very  recently, after multiple attempts to get a response, I did indeed receive one. None of it was overly surprising, though there were some points made that I will break down and comment on. The following is a copy of my correspondence, which although sent to Minister Anton, was ultimately sent back to me from Blain Lawson, GM and CEO of the BC Liquor Distribution Branch.

recently, after multiple attempts to get a response, I did indeed receive one. None of it was overly surprising, though there were some points made that I will break down and comment on. The following is a copy of my correspondence, which although sent to Minister Anton, was ultimately sent back to me from Blain Lawson, GM and CEO of the BC Liquor Distribution Branch.

====

Dear Mr. Noonan:

Thank you for your June 7 and 15, 2015 emails to the Honourable Suzanne Anton, Attorney General and Minister of Justice, regarding the craft beer industry. I have been directed to reply to your correspondence. As per your June 26, 2015 exchange with April Kemick, the BC Liquor Distribution Branch’s Communications Manager, we understand that you were looking for some responses – attributable to the Minister – to the questions below. We also understand that you will publish the responses for the CAMRA blog online. As per your request, the BC Liquor Distribution Branch worked with the Minister’s team to provide you with the answers below.

Thank you for taking the time to write.

Sincerely,

R. Blain Lawson

General Manager and Chief Executive Officer

BC Liquor Distribution Branch

2625 Rupert Street, Vancouver, BC V5M 3T5

T: 604-252-3021

1. The revenue collected from the price increase hasn’t been passed on to breweries, private retail stores or the public. Where is this revenue going, and in the first quarter since the reforms have passed, what is the approximate total revenue that has been collected from the increase?

B.C.’s recent liquor law changes have put all retailers on the same level playing field and meant that they now pay the same wholesale price for products. Moving forward, our expectation is that BC Liquor Stores (BCLS) competes in this new marketplace as a profitable retailer.

The BC Liquor Distribution Branch’s revenue – including that from BCLS – results in around $1 billion each year for government– which supports critical public services like education and health care for British Columbians.

Like any retailer, I know BCLS continually review their prices so they strike the right balance between being marketable to customers and being viable as a retailer. In order for BCLS to continue providing products that customers enjoy – such as craft beer – prices need to be sustainable.

The LDB made the decision to apply minimal price increases to some beer in June, while in other cases, price promotions were applied, making products less expensive. Retail prices have always fluctuated each month – and will continue to do so – as a result of new and expiring limited time offers, supplier price changes and price rounding.

It is important to understand that BC Liquor Stores are a retail business, just like any other. Therefore, the way we will be sharing our business information related to things like revenue and profit margins going forward, is something that is currently being reviewed.

The LDB will continue to remain transparent as we transition into this new, competitive environment.

2. Are the April 1 changes based on a model recommended by the $200,000 taxpayer-funded liquor reform report?

Revamping British Columbia’s liquor laws – including the wholesale price structure and the way BC Liquor Stores and the Liquor Distribution Branch do business – has been an extensive project.

The majority of the changes resulted from the Liquor Policy Review where Parliamentary Secretary John Yap met with many industry stakeholders and heard from thousands of members of the public to form his final report and its 73 recommendations. In addition to that, there have been a number of reports that have helped us along the way, including the one that Ernst & Young created for us.

It’s not uncommon for government to seek out independent policy advice. Looking at things from a different angle helps us to ensure that we provide a balanced approach to our decisions – keeping the best interest of all British Columbians in mind.

3. Given that it was taxpayer-funded, can you please provide a copy of this report? This may assist consumers in understanding the reasons behind the April first reforms.

If your question is referring to the Ernst & Young report, it is not publically available.

Ernst & Young was contracted to provide strategic advice on policy options – and that advice is currently subject to severing – done by professional public servants – under the Freedom of Information and Protection of Privacy Act. (FOIPPA)

FOIPPA is clear on what information can and cannot be released. Severing is done by professional public servants and the entire freedom of information process is overseen by the Privacy Commissioner.

4. What is the legal rationale for maintaining the ban on liquor consumption in public? Case studies and historical trends in other cities don’t show this as a catalyst to increased crime and helps to dilute the number of intoxicated persons in otherwise concentrated areas (e.g. Granville St). Given the benefits seen in the reduction of overconsumption in countries that lift these bans, why maintain the ban?

In British Columbia, generally, liquor may only be consumed within a liquor-licensed area or private dwelling. Preventing liquor consumption in unlicensed public areas is set within the Liquor Control and Licensing Act.

The rationale is one of public safety and community standards, and is in line with every other Canadian provincial jurisdiction. Local governments, have the option to designate public places under their jurisdiction, like local parks, as places where people can consume liquor. To date none have exercised this option. However, many local governments have been supportive of the open-site licensing option we put in place for festivals – so that patrons can consume liquor in a larger, open space as long as public safety is not at risk.

5. Craft brewing is a major growth industry for Vancouver; in of itself, as well as positively contributing to other major sectors, such as tourism. Can you expand on how the fair or “level playing field” the wholesale pricing is meant to provide benefits the province from the standpoint of nurturing economic growth in these two sectors, particularly in the long term?

By implementing a common wholesale price for all retailers – including BC Liquor Stores – the new model creates an even footing for industry that enhances customer convenience. By moving to a model where all retailers pay the same price for product, it was important that they were all able to offer the same benefits to consumers and do so in a competitive marketplace.

By implementing a common wholesale price for all retailers – including BC Liquor Stores – the new model creates an even footing for industry that enhances customer convenience. By moving to a model where all retailers pay the same price for product, it was important that they were all able to offer the same benefits to consumers and do so in a competitive marketplace.

In fact, some of the changes we’ve made that consumers were very clearly in favour of include allowing BC Liquor Stores to offer extended hours, Sunday openings, and refrigeration. These changes make it more convenient for customers to grab their favourite, ice cold, B.C. craft beer at stores throughout the province.

In the past two months alone, since the implementation of the new wholesale pricing model, craft beer sales at BC Liquor Stores have grown by more than 40 per cent. This growth indicates that customers continue to support the homegrown craft beer industry.

The new wholesale pricing model also contains common-sense policy changes, such as graduating the wholesale mark-up for small breweries, which stimulates growth and the creation of new jobs in this province. Beyond that, we’ve also relaxed laws around local farmers’ markets, making it easier for people to pick up the B.C. craft beer they love close to home.

With our government’s support, the B.C. craft beer industry has experienced significant growth. In fact, over the past five years, craft beer sales in this province have nearly tripled. The number of licensed breweries in B.C. has nearly doubled since 2012. And there are currently 112 licensed breweries operating in the province – 91 of which are craft breweries.

And we are not done – we are supporting the industry by taking a closer look at processes that can further growth as well. For example, we’re looking at the way we licence breweries – trying to find ways to cut red tape and open up new opportunities. We’re also looking into a quality assurance program for craft beer producers, similar to the successful VQA program for wine.

6. Prior to April 1, the profitability and success private retailers and breweries experienced helped to create jobs and drove business to local communities. The growth and sustainability of these trends are now at risk due to smaller margins and increased operational costs. This in mind, can you comment on how the liquor law changes stand to benefit local communities?

By all indications, the craft beer industry continues to flourish in this province with the support of our government and widespread public appeal. In terms of margins and operating costs, it is up to each supplier and retailer to make their own business decisions. However, to quote a few aforementioned statistics:

– Over the past five years, craft beer sales in this province have nearly tripled.

– The number of licensed breweries in B.C. has nearly doubled since 2012. And there are currently 112 licensed breweries operating in B.C. – 91 of which are craft breweries.

– In the two months since the implementation of the new wholesale pricing model, craft beer sales at BC Liquor Stores have grown by more than 40 per cent.

– The craft beer industry is estimated to employ over 2,500 people, with an additional 1,500 working in brewpubs owned by the craft brewers.

Increased craft beer sales and the steady addition of more breweries are directly translating into more jobs and economic growth for local communities.

7. There has been widespread disapproval of these changes, particularly in the way that they appear to target and affect craft beer more discriminately than it does macro breweries, wine, and spirits. Can you comment on why, for example, BC wineries are able to sell and deliver directly to consumers at prices that do not include all BCLDB fees (versus international wines), but BC craft breweries aren’t allowed to do so at a comparable pricing model?

I have actually heard significant support for many of the changes we have made coming out of the Liquor Policy Review. That said, I do understand that there have been some stakeholder concerns expressed about particular aspects of the changes that have been introduced. The Liquor Distribution Branch, the Liquor Control and Licensing Branch and I have been actively listening to those concerns and we are carefully watching the marketplace in these early days. The implementation of the Liquor Policy Review recommendations and the introduction of the wholesale pricing model has meant significant change in the industry – but change that we believe will be beneficial in the long term for both industry and consumers.

I certainly appreciate that industry will continue to have ideas for additional changes in liquor policy, and we’re open to hearing about them. That said, many of these changes have only been in place since April 1, and there was significant work and consultations undertaken to establish this new system.

With respect to land-based wineries and small production breweries, both sectors receive significant support from the provincial government. Land-based wineries have a substantial number of obligations they must meet in order to be designated as such (e.g. use 100 percent B.C. agricultural input, a minimum land requirement, among others). Consequently, the benefits that accompany that designation are likewise substantial.

Small production breweries in B.C. have a mark-up applied to their product that is a modest per litre amount, that starts at almost half of the mark-up applied to the products of the large, multinational brewers. This is to recognize the fact that the cost of production for small breweries is greater than larger breweries because they lack the economy of scale. Further, since April 1, there is no longer a different mark-up rate for packaged and draught product, and no retail margin is applied to draught product sold to hospitality customers.

The current approach is enabling both the B.C. winery and brewery sectors to flourish, as evidenced by the continual sales growth.

Understanding that there will always be ideas for change, moving forward, we will be looking to consider any new requests for policy changes on an annual basis. An annual consideration process will also mean industry can have confidence that government is taking a principled approach to ongoing liquor reform and is considering any and all proposals together and in context with each other.

In the meantime, I’d encourage industry to continue to submit their ideas for reform, and we will look to consider those prior to the end of this fiscal year.

======

Minister Anton touted these reforms as a means of “level the playing field” for retailers, while assuring the populous that, as  consumers, we would not see an increase in price at the register.

consumers, we would not see an increase in price at the register.

Neither of these claims proved to be true. Prices have increased noticeably since April 1, and the “level playing field” implemented has crippled the ability for private liquor stores to generate a profit; some more than others, but a change that universally impacts all private retailers nonetheless. An impact that travels downstream to consumers like you and I.

We are reminded over and over again: craft beer sales at provincial liquor stores are up more than 50 per cent compared to a year ago.

At *provincial* liquor stores.

If you ask most any private retailer about how the reforms have afftected business, at least one of the following three points are true:

– Sales of craft beer have diminshed in their stores

-Many products are no longer sales viable, and are no longer being stocked

-Profit margins have been heavily impacted, making opening and running small businesses less economically viable by eliminating job opportunities

The correlation here is undeniable. For the increases to be simply the beginning of a graduated markup is troubling, and will result in even less product diversity at a higher price.

Brewers and retailers and city officials have made very clear statements about both the importance of a healthy craft beer economy in British Columbia, as well as the entirely predictable negative impact these reforms have had on their business since April 1. Here are just a few statements from around the Lower Mainland:

“Craft brewing is revitalizing industrial areas of our cities, bringing new business activity, tourism, and investment to previously insular areas. The community surrounding craft beer are a hugely supportive, passionate group of people that have created valuable social capital within a growing industry, while their talent and expertise have put BC on the map as a craft beer destination. Economic and employment opportunities in craft brewing pose clear benefits to BC.”

-Diana McKenzie, Callister Brewing Co.

“Opening a brewery does a lot of things for a lot of different people. For starters, we have made a small community where there was none previously. We have neighbours, businesses and individuals come together in a space that never existed. Also, we have hired six individuals full time and ten people part time, which is a adding to the municipal, provincial and national economy. Craft beer in general brings people together, promotes local products, is hand crafted and is often made by people who are involved in the community. Craft beer also supports grassroots programs and activities as opposed to larger more national brands. It promotes honesty, genuine marketing and products that are inline with consumers expectations and desires. We are responding to what people want, versus telling people what they should and shouldn’t like. Cities and communities need businesses that are more than just bricks and mortar. We need local, grassroots organizations that are in touch with the current world, and promote and propel us forward to a sustainable, healthy, positive impact within the world … all of which craft beer is in my opinion.

The changes that were made April 1st have had a huge impact on our ability to make money and do the above. We are a new company (less than six months old), so the impact was much easier to absorb than it would be for other more established operations. In short, taking away from craft beer takes away from everything mentioned in the paragraph above – which is entirely backwards and counter productive. We need to foster small business, which can support our economy, through a down-to-earth approach and basic business.”

-Aaron Jonckheere, Strange Fellows Brewing

“The explosion of local craft beer production in BC has revitalized what was becoming a stale market totally dominated by the industrial brewers. Our clientele not only supports local craft beer; they demand it and our stores selection reflects that. We simply don’t sell any of the large industrial beers mostly by our choice but also because it is not what people ask for when they come to our stores.

The increased pricing slapped on craft beer is very misguided. They are penalizing the most knowledgeable and discerning consumers for their desire to drink great beer while supporting the local craft breweries, many of who are now their neighbours and friends. It smells to me of protectionism for the large industrial breweries that are steadily losing market share.”

-Robert Simpson, Liberty Wine Merchants

“In Canada, the craft beer industry supports jobs and strong local economies. In New Westminster, the sector is not only growing, its developing strategic partnerships with other local businesses and organizations which amplify the positive economic benefits in our city.”

-Jonathan X Coté: Mayor, New Westminster

“We have seen first hand the success of the craft brew market, with Yellow Dog, Moody Ales, and soon, Twin Sails breweries opening in Port Moody. Our residents appreciate the ability to have easy access to the quality products the breweries are pouring, to sample some of the new and different short run beers, and even enjoy the full experience with tours and tastings at the brew houses. I didn’t know what a growler was 2 years ago.. now we see them everywhere. These business are not only serving Port Moody residents, but are drawing in customers from all over the region – visitors to our City that also visit our many other great local retailers, restaurants and independent businesses. Port Moody is a small town, and these locally owned and operated craft breweries compliment and support our community and our residents.

I look forward to their continued success, and hope that they are treated fairly and equitably under the liquor laws/regulations, that currently seem to favour the large, national brands.”

–

– Mike Clay: Mayor, Port Moody

It is egregious to entertain the illusion of these reforms benefitting anyone other than the provincial government. An adjustment in pricing to bring the cost of craft beer products in provincial stores down to the level the that has allowed privately owned businesses (not to mention, an entire culture) to thrive – would have done far more to serve our communities.

Many questions and great concern fuel my pursuit of the EY report, unredacted in its’ entirety. We as taxpayers deserve to understand the reasoning behind the methodology that fueled these changes. We as taxpayers have important decisons to make with our votes, which by mechanics beyond our control have been skewed and forcibly shaped through a lack of available information. Information by which important legislature is passed and effected. Information that is imperative in making informed and rational decisions about our elected governing parties.

John Yap’s announcement last week regarding review and adjustment of the April 1 reforms is, at face value, progress in the right direction – but comes at a cost. Do we accept this with blind hope? If you look at his past positions on liquor laws and craft beer in general, you might be inclined to chalk this announcement up as conveniently-timed political positioning.

Do not mistake my cynicism as refusal to consider: I hope very much that these reviews quickly and concisely correct the very major damage these reforms have done to our ecosystem. Does that mean I accept this announcement as a guarantee that these grievances will be addressed in a way that provides genuine benefit to consumers and retailers? Absolutely not.

Our community has a right to the facts. Information that determines how we vote, and how and where we spend. It is with careful approach that we must navigate this going forward. Voicing discontent and reflecting indignation without a clear understanding of what we are fighting against is, ultimately, not very helpful. This is why we need to come together to impart the message that this type of forced change isn’t acceptable. That we are entitled to a say, and that – like any product purchased by the money we work every day to earn – we deserve to get what we paid for.

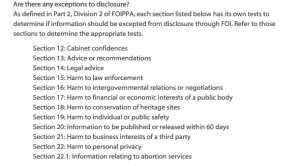

The government has rejected multple requests for the unredacted version of the E&Y report, exercising four sections of the Act. Sections 12, 13, 17 and 21, respectively. Details of these exceptions can be found here:

The government has rejected multple requests for the unredacted version of the E&Y report, exercising four sections of the Act. Sections 12, 13, 17 and 21, respectively. Details of these exceptions can be found here:

http://www.bclaws.ca/civix/document/id/complete/statreg/96165_00

The FOIPPA request that the Independent Wine Retail Association was denied based on these points, and while the rejection itself is frustrating, having clear points in which to challenge is actually very useful. The request for review and appeal was then submitted, and at present I have been working with the assistance of legal professionals to build a platform on which to press an appeal.

The challenge ahead of us is to establish precedent for our reasons of arguing the allowance of these sections of the Act. Here is where you can help. We need to be able to argue that these exceptions shouldn’t be allowed to obfuscate justice based on previous instances where these exceptions have impeded due justice and have been overruled. Cases where an argument was successfully made that by permitting these exceptions to prevent the release of information, the law and the foundational mechanics of public trust become jeopardized. There are a huge number of records to search through in our effort to establish this, but it is in your power to get involved. The database available at www.canlii.org is invaluable; if you wish to participate in this research and need some assistance in how and what to look for, you can contact me directly.

In short? Progress takes time, but be assured that we have a direction in which to drive our efforts. 12, 13, 17, 21. Navigating these Sections of the Act successfully is the only way we will ever know how we arrived to these reforms. Knowledge that is necessary in order to establish responsible, effective opposition. Having these exceptions overturned and gaining access to this document will be an enormous advance in our efforts to undo the damage here.

To Minister Anton, I say this: you have a closing window of opportunity to offer some transparency and recover some of the public trust that has been so terribly squandered. FOIPPA is not a static shield behind which you can hide. Rather than working against consumers, why not work with us? After all, cards are revealed at the end of every hand you play.

Ante up.

Jeremy Noonan

Community Liaison,

CAMRA BC – Vancouver Branch

@jerryvillainous

Leave a Reply